When it comes to life insurance, our advisors prefer to educate people so they can make sound decisions for themselves and their families. Rather than getting the most insurance someone can afford, it is usually wise to analyze needs and timelines, as well as other financial goals, then insure appropriately.

When it comes to life insurance, our advisors prefer to educate people so they can make sound decisions for themselves and their families. Rather than getting the most insurance someone can afford, it is usually wise to analyze needs and timelines, as well as other financial goals, then insure appropriately.

As an independent marketing company, we represent a variety of different life carriers in order to meet the specific and individual needs of today’s clients. We offer a greater variety of unique solutions and better rates than even many Internet sources. There is, too, the critical advantage of working with a live person, our advisors, to guide the client step-by-step.

Our advisors generally offer best-rate solutions including Term, Return of Premium, and Quality of Life insurance, as well as permanent insurance when and if it’s appropriate. Life insurance through HBW’s Life division offers solutions for:

- Estate planning

- Pension maximization

- Older-age clients

- New families

- Cancer-survivors, diabetics, and other less-than-healthy clients

- Tobacco users

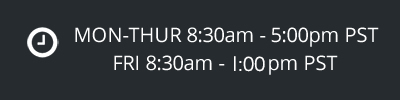

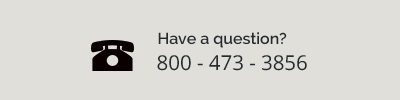

Contact us today to learn more about Life Insurance options.

*Disclaimer: The information provided is not intended as legal or tax advice and may not be relied on for purposes of avoiding federal tax penalties. All individuals, including those involved in the estate planning process, are advised to meet with their tax and legal advisors. The individual sponsoring this advertising will work with your tax and legal advisors to help select appropriate product solutions. The publisher does not assume liability for financial decisions based on the advertising contents.

Investment advisory services may also be offered through HBW Advisory Services LLC. HBW Insurance & Financial Services, Inc. dba HBW Partners and HBW Advisory Services LLC are separate entities which do not offer legal or tax advice. IAPD